-

Tips for Starting a Farming Business

Starting a farming business requires planning a business, procuring land, securing financing, and understanding agricultural law. For this reason, you should seek guidance from an agribusiness attorney near Wichita . Your agricultural lawyer can help you develop the vision and values for your farm while helping you carefully plan to manage risk.

Starting a farming business requires planning a business, procuring land, securing financing, and understanding agricultural law. For this reason, you should seek guidance from an agribusiness attorney near Wichita . Your agricultural lawyer can help you develop the vision and values for your farm while helping you carefully plan to manage risk. Select a farm specialty

There are three categories of farmingâcrop, wind and animal farming. While crop farmers grow plants, like corn or trees for lumber, animal farmers raise animals for food products like milk and beef. Government grants have created the new farming specialty of wind farming, where farms utilize wind turbines to harness wind energy. Farmers should base their specialty decisions based on their locations and their levels of education.

Develop a business plan

Working with a business lawyer is a great way to develop a farm business plan, which covers startup expenses, operating expenses, and projected profitability. A farmer must develop a business plan in order to apply for farm loans and government grants. Contacting the state agricultural department can help a farmer obtain information on crops, product distribution and warehousing information. An agricultural law firm can also help a new farmer apply for federal, state and county grants.

Acquire finances

A farmer needs financing for the farm, the equipment and for living expenses. For this reason, itâs essential for a farmer to include living expenses as part of the business plan because his or her income will be delayed until the farm produces. An existing farm can obtain cash grants, including crop or dairy subsidies. A new farm can apply for loans from the United States Department of Agriculture. Monitoring and controlling finances is crucial for a farmâs survival, so itâs a good idea to work with an accountant as well as an agricultural lawyer.

Research laws

All business regulatory laws apply to farming, so itâs crucial for a farmer to become familiar with agricultural and business law. An agricultural law attorney can help a new farmer properly structure the farm as a sole proprietorship, partnership, or limited liability company.

-

Understanding the 2014 Agricultural Act

On February 7, 2014, Congress signed the Agricultural Act of 2014 into law, which authorizes nutrition and agriculture programs in the United States between 2014 and 2018. Additionally, the Bill authorizes the spending of approximately $956 billion over the next ten years. The farm bill is the federal governmentâs primary agricultural and food policy tool, so itâs important to discuss the Actâs implications with an agricultural lawyer near Wichita .

On February 7, 2014, Congress signed the Agricultural Act of 2014 into law, which authorizes nutrition and agriculture programs in the United States between 2014 and 2018. Additionally, the Bill authorizes the spending of approximately $956 billion over the next ten years. The farm bill is the federal governmentâs primary agricultural and food policy tool, so itâs important to discuss the Actâs implications with an agricultural lawyer near Wichita . Farm bills

Approximately every five years, Congress passes a comprehensive omnibus bill to address agricultural law. Usually, it amends or suspends provisions of permanent law. Congress may also pass a bill that amends or repeals provisions of earlier temporary agricultural acts. Since 1973, farm bills have included titles on trade, rural, farm credit, agricultural research, and nutritional programs. The farm bill was first created during the Great Depression in an effort to help farmers who were financially struggling with excess crop supplies. These bills can be very controversial, as they impact international trade, environmental conservation, and food safety.

Provisions of the bill

The Agricultural Act of 2014 cuts $8 billion from the Supplemental Nutrition Assistance Program. However, the bill does allocate $200 million extra in funding to food banks. The bill also institutes income caps on farm subsidies, implements a price support program for dairy farmers, and terminates direct payment subsidies. Previously, direct payment subsidies compensated farmers whether or not they actually grew crops, which cost $5 billion per year. The bill also eliminates federal restrictions on growing industrial hemp, allowing states that have legalized hemp manufacturing to set up research programs on the benefits.

Procedural history

An agricultural law firm closely follows how the farm bill impacts agribusiness across the country. An agricultural lawyer understands the regulatory issues facing agricultural producers and agricultural service providers. The Agricultural Act of 2014 was first introduced into the United States House of Representatives as the Federal Agricultural Reform and Risk Management Act of 2013. After the Senate voted to amend the bill, the House voted to pass the bill on January 27, 2014. On February 4, 2014, the Senate approved the full five-year bill.

-

What Agribusinesses Need to Know About Property Taxes

Running a family farm or ranch has become increasingly difficult in light of environmental disasters, low profitability, high property taxes, and unfavorable laws and regulations. To ensure the success of your agribusiness, you can turn to an agribusiness lawyer in Wichita, who can help you sort through agribusiness law . One of the many difficulties your agricultural lawyer can help you overcome is unfair property taxes. If you believe your property taxes are far too high, youâre certainly not alone.

Running a family farm or ranch has become increasingly difficult in light of environmental disasters, low profitability, high property taxes, and unfavorable laws and regulations. To ensure the success of your agribusiness, you can turn to an agribusiness lawyer in Wichita, who can help you sort through agribusiness law . One of the many difficulties your agricultural lawyer can help you overcome is unfair property taxes. If you believe your property taxes are far too high, youâre certainly not alone. Valuations and Assessments

One of the reasons why so many agribusiness owners turn to an agricultural lawyer is because of unfair valuations and assessments, which can lead to unjustly high property taxes. Given the vast amount of land that county appraisers must assess, itâs no small surprise that errors do occur on a frequent basis. An agricultural lawyer can help you determine if your assessment should be adjusted based on many factors, including the amount of land you have and where itâs located with regard to average rainfall.

Property Tax Abatement

Some agribusiness owners may be able to obtain a property tax abatement, which is the elimination or drastic reduction of property taxes for a set number of years. The property tax abatement may involve the total amount of land, buildings, and improvements, or it may involve a partial amount. Generally, a property tax abatement can remain valid for up to 10 years.

Senate Bill 178

All agribusiness owners should consult their lawyers regarding changes that may occur in the event Senate Bill 178 is signed into law. The bill was recently introduced in Kansas by Sen. Jeff Melcher (R-Leawood), who wants agribusiness owners to be taxed in the same way as owners of any other type of property. If this bill had been introduced earlier and had been passed in 2014, agriculture land values would have been raised by 473 percent, according to the Salina Journal . Given the importance of agriculture to the Kansas economy, opponents of the bill state that it would be significantly detrimental to agribusinesses and Kansas as a whole.

-

A Look at the Challenges Facing Agricultural Businesses

By necessity, agribusiness owners have a keen sense of the relationship between their land and their wealth. Efforts to ensure sustainability have become more important than ever, given dire predictions about water scarcity and many other factors that threaten both farmers and the global food supply as a whole. One critical step farmers can take to ensure their long-term success is to consult an agribusiness lawyer in Wichita. An agricultural lawyer with extensive experience in agribusiness law can help you navigate regulations, transactions, compliance, and many other issues, which allows you to focus on the future of your farm.

By necessity, agribusiness owners have a keen sense of the relationship between their land and their wealth. Efforts to ensure sustainability have become more important than ever, given dire predictions about water scarcity and many other factors that threaten both farmers and the global food supply as a whole. One critical step farmers can take to ensure their long-term success is to consult an agribusiness lawyer in Wichita. An agricultural lawyer with extensive experience in agribusiness law can help you navigate regulations, transactions, compliance, and many other issues, which allows you to focus on the future of your farm. Water Scarcity

The lengthy drought affecting many states in the U.S. has become a matter of increasing concern for farmers and environmentalists alike. The term âwater crisisâ is being used with increasing frequency and recent studies have demonstrated an alarming loss of groundwater in many of the western states. Farmers in Kansas and adjacent states in particular have become concerned about the imminent depletion of the Ogallala aquifer, which is relied upon by millions in the Great Plains area. Pollution of local rivers and lakes is another common concern of Kansas farmers. Itâs advisable to consult an agricultural lawyer regarding regulations that may apply to chemical runoff.

Monoculture

Before pesticides became heavily used, farmers relied on sustainable techniques such as crop rotation, the use of cover crops, and other techniques that naturally replenish the soil. With the widespread use of pesticides and genetically modified seeds, farmers turned to monoculture, which refers to reliance on a solitary crop with demonstrable profitability. However, scientific studies have begun to shed light on the drawbacks of this practice and some farmers have responded by turning once again to traditional and sustainable agricultural practices .

Post-Harvest Loss

Post-harvest loss is a major concern for farmers and consumers alike. In developed countries, post-harvest loss most often takes the form of food waste, which is perpetrated by the consumer. However, post-harvest loss also commonly occurs due to deficits in harvesting techniques, storage methods, and transportation. Not only does post-harvest loss spell trouble for the global food supply; it also significantly affects the individual farmerâs bottom line.

-

How Can an Attorney Help Your Agribusiness?

If you own a farm or ranch, you know you have to run it like a business in order to maintain a successful enterprise. Like any business owner, farmers and ranchers can benefit from the counsel of an experienced business lawyer, especially one who is well-versed in agricultural law. An agribusiness attorney in Wichita will serve your interests by offering legal advice on government programs and regulations, property matters, and agribusiness planning.

If you own a farm or ranch, you know you have to run it like a business in order to maintain a successful enterprise. Like any business owner, farmers and ranchers can benefit from the counsel of an experienced business lawyer, especially one who is well-versed in agricultural law. An agribusiness attorney in Wichita will serve your interests by offering legal advice on government programs and regulations, property matters, and agribusiness planning. While there are government programs available to financially assist farmers and ranchers, there are also environmental, labor, and regulatory policies that can restrict day-to-day operations and ultimately affect the bottom line. An agricultural lawyer will ensure that you remain in compliance with the law and will pursue any government benefits that may be available to you. Farmers must also protect their real property, as the land is their livelihood. You can rely on an agribusiness attorney to handle such property issues as farm and mineral leases, collateralization, liens, water rights, property taxes, and more. A lawyer with experience in both agriculture and business can also assist with financial planning, succession planning, and tax filing to preserve the ongoing health of your agricultural enterprise.

-

How Can an Attorney Help Your Agribusiness?

How Can an Attorney Help Your Agribusiness?

If you own a farm or ranch, you know you have to run it like a business in order to maintain a successful enterprise. Like any business owner, farmers and ranchers can benefit from the counsel of an experienced business lawyer, especially one who is well-versed in agricultural law. An agribusiness attorney in Wichita will serve your interests by offering legal advice on government programs and regulations, property matters, and agribusiness planning.

If you own a farm or ranch, you know you have to run it like a business in order to maintain a successful enterprise. Like any business owner, farmers and ranchers can benefit from the counsel of an experienced business lawyer, especially one who is well-versed in agricultural law. An agribusiness attorney in Wichita will serve your interests by offering legal advice on government programs and regulations, property matters, and agribusiness planning. While there are government programs available to financially assist farmers and ranchers, there are also environmental, labor, and regulatory policies that can restrict day-to-day operations and ultimately affect the bottom line. An agricultural lawyer will ensure that you remain in compliance with the law and will pursue any government benefits that may be available to you. Farmers must also protect their real property, as the land is their livelihood. You can rely on an agribusiness attorney to handle such property issues as farm and mineral leases, collateralization, liens, water rights, property taxes, and more. A lawyer with experience in both agriculture and business can also assist with financial planning, succession planning, and tax filing to preserve the ongoing health of your agricultural enterprise.

-

The Importance of Finding a Lawyer with Experience in Agribusiness Law

Any lawyer can draw up a contract or advise a client as to applicable state laws and regulations. But only an experienced agribusiness lawyer near Wichita can draw from an in-depth knowledge of the challenges that farmers face on a daily basis. A good agribusiness lawyer doesn’t only ensure that their clients remain in compliance with chemical regulations; he or she also helps agribusinesses flourish in today’s demanding marketplace.

Any lawyer can draw up a contract or advise a client as to applicable state laws and regulations. But only an experienced agribusiness lawyer near Wichita can draw from an in-depth knowledge of the challenges that farmers face on a daily basis. A good agribusiness lawyer doesn’t only ensure that their clients remain in compliance with chemical regulations; he or she also helps agribusinesses flourish in today’s demanding marketplace. An agricultural lawyer works closely with livestock, grain, and produce companies to facilitate agribusiness growth across a range of areas. For example, your agricultural lawyer can provide expert advice with regard to farm labor and immigration issues, farm leases, agriculture loans and workouts, and entity formation. Agricultural law also encompasses groundwater and irrigation issues, farm estate planning, business finance, and risk management. With all the expertise that a veteran agricultural lawyer brings to the table, your agribusiness can’t afford not to work with one.

-

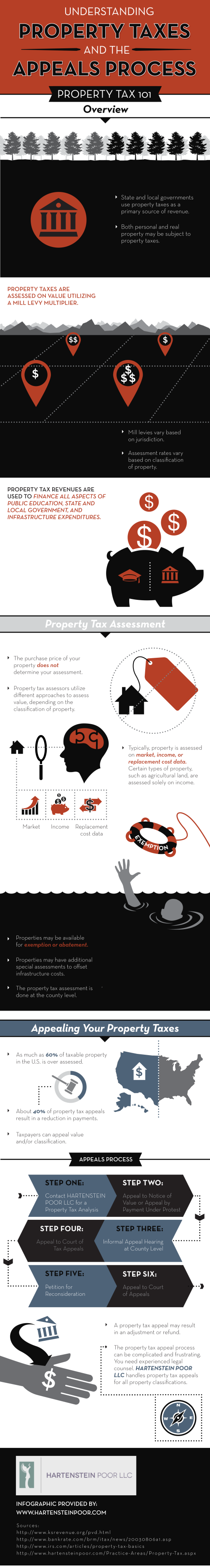

Understanding Property Taxes and the Appeals Process

Property taxes have been around for many years, with evidence showing that even ancient civilizations levied taxes on property owners. While much has changed since ancient times, homeowners are still required to pay property taxes that are dependent on a property’s assessed value. Property taxes can be calculated in a few different ways, but research shows that as much as 60% of taxable property in the country is assessed at more than it is actually worth. If you think your property taxes are unreasonable, trust Hartenstein Poor LLC, property lawyers near Wichita , to help you through the appeals process. Approximately 40% of appeals result in a reduction of fees or a refund, so protesting your taxes could pay off. Take a look at this infographic to understand more about the basics of property taxes and why you should consider appealing. Please share with your friends and neighbors.