-

How to Choose a Business Structure

How to Choose a Business Structure

Before you can start your business, you need to decide which structure it will have. If you’re not quite sure which business structure is right for your needs and preferences, it’s best to consult a business law firm near Wichita . A business lawyer can explain the differences between a limited liability company (LLC) and limited liability partnership (LLP), for example. You can also learn about partnerships and being a sole proprietor. Your corporate attorney can help you consider some important factors before choosing a business structure.

You can hear more about the factors you should consider by watching this video. This expert encourages entrepreneurs to consult a business attorney to discuss preferences for exposure to liability and tax implications.

-

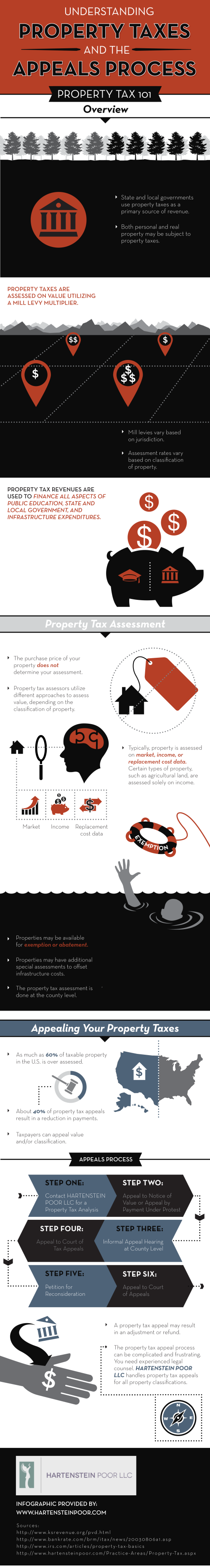

Understanding Property Taxes and the Appeals Process

Property taxes have been around for many years, with evidence showing that even ancient civilizations levied taxes on property owners. While much has changed since ancient times, homeowners are still required to pay property taxes that are dependent on a property’s assessed value. Property taxes can be calculated in a few different ways, but research shows that as much as 60% of taxable property in the country is assessed at more than it is actually worth. If you think your property taxes are unreasonable, trust Hartenstein Poor LLC, property lawyers near Wichita , to help you through the appeals process. Approximately 40% of appeals result in a reduction of fees or a refund, so protesting your taxes could pay off. Take a look at this infographic to understand more about the basics of property taxes and why you should consider appealing. Please share with your friends and neighbors.