-

Avoiding an Audit from the IRS

If youâre a business owner, you need to pay very close attention to your financial matters, including your tax payments. An IRS audit can be a stressful procedure, even with the guidance of a tax lawyer near Wichita . To reduce your chances of being audited, your business lawyer will advise you to keep meticulous records of all income, expenses, and other losses. Doing so can help you avoid making mistakes on your tax returns.

To learn about the issues that could trigger an audit, consult your business tax lawyer and watch this brief video. This video explains why you might hesitate to claim more than $1,600 in charitable deductions, why you should never round figures for your deductions, and which types of business owners need to be especially cautious about the possibility of an audit. Bear in mind that the IRS selects some tax returns at random each year for an audit, regardless of how closely those taxpayers followed the rules. Always consult a business lawyer if youâre one of those unfortunate taxpayers.

-

What Do You Need to Know About Tax Law?

If youâve already retained the services of a business lawyer in Wichita to manage affairs that involve corporate law , youâve made a wise decision. Your business lawyer can ensure that your company remains in compliance with all relevant regulations and he or she can provide specific guidance on certain situations as they arise. However, it never hurts to familiarize yourself with the basics of the regulations that apply to your business, particularly tax law. Before reading these regulations, it can be helpful to have a basic understanding of common tax law terminology.

If youâve already retained the services of a business lawyer in Wichita to manage affairs that involve corporate law , youâve made a wise decision. Your business lawyer can ensure that your company remains in compliance with all relevant regulations and he or she can provide specific guidance on certain situations as they arise. However, it never hurts to familiarize yourself with the basics of the regulations that apply to your business, particularly tax law. Before reading these regulations, it can be helpful to have a basic understanding of common tax law terminology. Regulations

You can find IRS regulations published in the Federal Register. Regulations serve as guidance for new additions to the tax code. They help taxpayers understand their obligations and how to remain in compliance with legislation . The IRS may also publish regulations to resolve any issues that may arise with already existing tax codes.

Private Letter Rulings

Sometimes, a taxpayer or a business attorney might submit a written request to the IRS for information. For example, the taxpayer may wish to know how the IRS tax code applies to a particular transaction or other circumstance. In response, the IRS will issue a private letter ruling (PLR), which interprets relevant sections of the tax code for the taxpayer and helps the individual understand how tax laws are applicable to the situation. Provided the taxpayer fully and accurately informed the IRS of the situation and acts as instructed, the PLR is binding on the IRS.

Revenue Rulings

Like regulations, revenue rulings are a form of guidance issued by the IRS to help taxpayers and tax professionals understand how tax laws apply to certain situations. Revenue rulings are considered to be official interpretations made by the IRS. For example, a revenue ruling might explain how a taxpayer might deduct a home office.

Revenue Procedures

Revenue procedures are similar to revenue rulings. However, while revenue rulings provide information on the position of the IRS regarding a particular situation, a revenue procedure provides taxpayers and professionals with instructions. For example, a revenue ruling might explain the circumstances in which a home office deduction is allowed. A revenue procedure might explain how to determine the percentage of the home that is devoted entirely to business purposes and how to claim the deduction.

-

What Can and Can’t be Included in Your Property Tax Deduction?

What Can and Can’t be Included in Your Property Tax Deduction?

The property tax system in the United States is incredibly complicated, and most taxpayers are unable to understand or decipher why their property taxes increase every year. Ballooning property taxes are often the result of errors and inaccuracies on the part of county appraisers, which can be addressed with the help of a property tax attorney in Wichita . Still, you’ll have property taxes to pay each year. Fortunately, that means you’ll have property tax deductions as well. Read over this brief list of items that can be included in your property tax deduction and then consult with a property attorney to handle your property tax issues.

The property tax system in the United States is incredibly complicated, and most taxpayers are unable to understand or decipher why their property taxes increase every year. Ballooning property taxes are often the result of errors and inaccuracies on the part of county appraisers, which can be addressed with the help of a property tax attorney in Wichita . Still, you’ll have property taxes to pay each year. Fortunately, that means you’ll have property tax deductions as well. Read over this brief list of items that can be included in your property tax deduction and then consult with a property attorney to handle your property tax issues. Deductible Payments

If you took out a mortgage to finance the purchase of your home, your house payments may include several other costs in addition to paying off the loan, many of which you can deduct from your income taxes at the end of the year. You can deduct real estate taxes paid to the taxing authority, interest that qualifies as home mortgage interest, and mortgage insurance premiums. If you receive a housing minister’s or military housing allowance, you can still deduct your real estate taxes and your home mortgage interest without needing to reduce deductions based on your non-taxable allowance.

Nondeductible Payments

As many deductions as you can take, there are even more costs that you cannot deduct as part of your property tax deductions . You cannot deduct insurance, including fire and comprehensive coverage. Depreciation is also not deductible, at least not on an individual tax return for private property. The cost of utilities such as gas, electricity, and water cannot be deducted, nor can most settlement costs or forfeited deposits or down payments. Contact a property tax attorney in Wichita for help maximizing your property tax deductions this year.

-

Filing a Property Tax Appeal in Kansas

Filing a Property Tax Appeal in Kansas

According to the National Taxpayers Union, approximately 40% of tax appeals in the U.S. result in a reduction. That’s because ad valoreum valuation and assessment systems are an inexact science

and county appraisers are prone to mistakes just like anyone else. If you are appealing the valuation or classification assigned by your local county appraiser, you will need to file Equalization Appeal Forms (provided by your county appraiser along with the county’s hearing result letter) and a Payment Under Protest Form. A filing fee is assessed for property tax appeals except those involving single-family residential properties.

A Wichita property attorney can help with your property tax appeal, including informal appeals at county-level and state appeals. As the former Chairman of the Kansas Real Estate Appraisal Board, property attorney Scott B. Poor has the skill set and knowledge to make sure that your property’s valuation and assessment is fair.

-

A Look at Property Taxes in Kansas

A Look at Property Taxes in Kansas

Did you know that the property tax is widely considered to be the most reviled type of tax levied upon Americans? Aside from the tendency of property taxes to rise year after year, this is likely because many homeowners feel that their homes have an excessively high appraised value. Fortunately, there are options available to homeowners and those who own commercial, industrial, agricultural, and mineral properties. A tax lawyer near Wichita can help Kansas property owners by filing a property tax appeal. As your property attorney is likely to inform you, almost half of all property tax appeals result in a reduction.

Did you know that the property tax is widely considered to be the most reviled type of tax levied upon Americans? Aside from the tendency of property taxes to rise year after year, this is likely because many homeowners feel that their homes have an excessively high appraised value. Fortunately, there are options available to homeowners and those who own commercial, industrial, agricultural, and mineral properties. A tax lawyer near Wichita can help Kansas property owners by filing a property tax appeal. As your property attorney is likely to inform you, almost half of all property tax appeals result in a reduction. Appraisals of Properties

Your property attorney can answer any questions you have about the appraisal of your property. In Kansas, the county appraiser is required to view the exterior of all properties in the county every six years. The purpose is to determine the market value of your home . If your home’s appraised value goes up, you could be responsible for paying more in property taxes, depending on the budgetary needs of your municipality.

Factors that Determine Market Value

Your tax lawyer can help you understand the various factors that an appraiser considers when determining market value. These factors include the age, location, condition, quality, size, and style of the property. Then, the appraiser uses at least one method to determine market value. The first method is by comparing sales of properties that are similar to yours. The second is by considering the age of your property and what it would cost to replace it. The third applies to income-producing properties. It involves considering income from rent.

Methods of Protesting Home Values

If you feel that the appraised value of your home is too high and that you’re paying too much in property taxes, your tax attorney can file an appeal on your behalf. Within 30 days of receiving the notice of your property’s appraised value, your attorney can submit a protest to the county appraiser’s office. Or, your attorney may help you fill out a “payment under protest” form when you pay your property taxes.

-

Parties that May Be Exempt from Property Taxes

Parties that May Be Exempt from Property Taxes

If you’re like many property owners, you may already think that you’re paying too much in property taxesâand you could be right. In fact, a property tax lawyer in Wichita may be able to help you save a bundle on your property taxes by applying for various exemptions. State and municipal law varies regarding property tax exemptions; a tax lawyer can determine which exemptions you may qualify for.

If you’re like many property owners, you may already think that you’re paying too much in property taxesâand you could be right. In fact, a property tax lawyer in Wichita may be able to help you save a bundle on your property taxes by applying for various exemptions. State and municipal law varies regarding property tax exemptions; a tax lawyer can determine which exemptions you may qualify for. Homeowners

Many homeowners qualify for the homestead exemption. The regulations regarding this exemption may require you to re-apply each year. The qualifying criteria can vary widely; some states base eligibility requirements on age or income level. If you qualify for the homestead exemption, you won’t need to pay property taxes on part of your home’s value. For example, if you own a $250,000 home, $100,000 of that may be exempt. This means you’ll only need to pay property taxes on $150,000 of the home.

Military Veterans

Be sure to let your property attorney know if you’re a military veteran. Veterans often qualify for property tax exemptions if they were honorably discharged, served during times of war, and consider the property to be their primary residence. However, your area may impose additional restrictions, such as those involving the length of service and whether or not you sustained a disabling injury while in the service.

Senior Citizens and Disabled Individuals

Many states provide property tax exemptions to individuals simply because they’ve had a certain number of birthdays. For example, Kansas has a Safe Senior property tax exemption, which provides tax relief to homeowners who are at least 65 years old and meet income qualifications. Some homeowners may also be granted relief if they can prove that they have a disability. For example, a property attorney might use an individual’s eligibility for Social Security disability benefits as proof of qualification.

Home Renovators

Even if you’re not a senior citizen, a disabled individual, or a military veteran, you may still qualify for a property tax exemption if you make certain upgrades to your home. Home improvement exemptions vary considerably; your property attorney can find programs that apply to your area. For example, you may gain property tax relief simply by improving the energy efficiency of your home with solar panels or other upgrades.

-

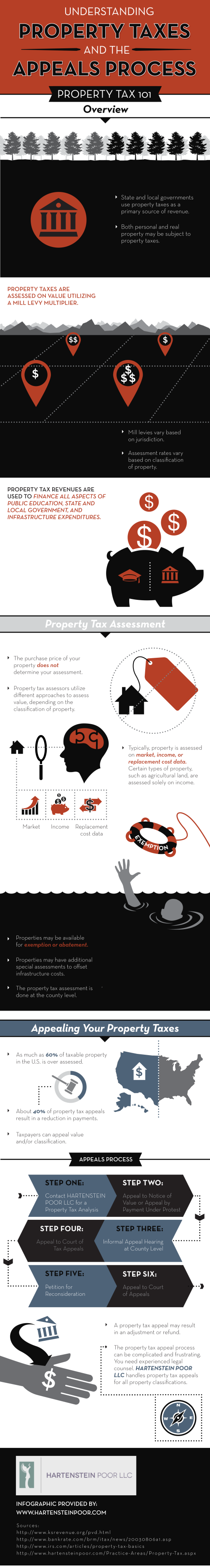

Understanding Property Taxes and the Appeals Process

Property taxes have been around for many years, with evidence showing that even ancient civilizations levied taxes on property owners. While much has changed since ancient times, homeowners are still required to pay property taxes that are dependent on a property’s assessed value. Property taxes can be calculated in a few different ways, but research shows that as much as 60% of taxable property in the country is assessed at more than it is actually worth. If you think your property taxes are unreasonable, trust Hartenstein Poor LLC, property lawyers near Wichita , to help you through the appeals process. Approximately 40% of appeals result in a reduction of fees or a refund, so protesting your taxes could pay off. Take a look at this infographic to understand more about the basics of property taxes and why you should consider appealing. Please share with your friends and neighbors.