-

Parties that May Be Exempt from Property Taxes

Parties that May Be Exempt from Property Taxes

If you’re like many property owners, you may already think that you’re paying too much in property taxesâand you could be right. In fact, a property tax lawyer in Wichita may be able to help you save a bundle on your property taxes by applying for various exemptions. State and municipal law varies regarding property tax exemptions; a tax lawyer can determine which exemptions you may qualify for.

If you’re like many property owners, you may already think that you’re paying too much in property taxesâand you could be right. In fact, a property tax lawyer in Wichita may be able to help you save a bundle on your property taxes by applying for various exemptions. State and municipal law varies regarding property tax exemptions; a tax lawyer can determine which exemptions you may qualify for. Homeowners

Many homeowners qualify for the homestead exemption. The regulations regarding this exemption may require you to re-apply each year. The qualifying criteria can vary widely; some states base eligibility requirements on age or income level. If you qualify for the homestead exemption, you won’t need to pay property taxes on part of your home’s value. For example, if you own a $250,000 home, $100,000 of that may be exempt. This means you’ll only need to pay property taxes on $150,000 of the home.

Military Veterans

Be sure to let your property attorney know if you’re a military veteran. Veterans often qualify for property tax exemptions if they were honorably discharged, served during times of war, and consider the property to be their primary residence. However, your area may impose additional restrictions, such as those involving the length of service and whether or not you sustained a disabling injury while in the service.

Senior Citizens and Disabled Individuals

Many states provide property tax exemptions to individuals simply because they’ve had a certain number of birthdays. For example, Kansas has a Safe Senior property tax exemption, which provides tax relief to homeowners who are at least 65 years old and meet income qualifications. Some homeowners may also be granted relief if they can prove that they have a disability. For example, a property attorney might use an individual’s eligibility for Social Security disability benefits as proof of qualification.

Home Renovators

Even if you’re not a senior citizen, a disabled individual, or a military veteran, you may still qualify for a property tax exemption if you make certain upgrades to your home. Home improvement exemptions vary considerably; your property attorney can find programs that apply to your area. For example, you may gain property tax relief simply by improving the energy efficiency of your home with solar panels or other upgrades.

-

Protecting Your Business During Divorce

Protecting Your Business During Divorce

Individuals who own their own businesses tend to take a great deal of pride in them and to invest countless hours in their growth. Unfortunately, your ex-spouse could take a share in a divorce. As any family lawyer will advise you, getting a prenuptial agreement prior to the marriage is the best way to protect your business in the event of a future divorce. A family attorney located in Wichita can draft an ironclad prenuptial agreement, which can specify that your business and all of its assets are not to be considered shared marital property.

Individuals who own their own businesses tend to take a great deal of pride in them and to invest countless hours in their growth. Unfortunately, your ex-spouse could take a share in a divorce. As any family lawyer will advise you, getting a prenuptial agreement prior to the marriage is the best way to protect your business in the event of a future divorce. A family attorney located in Wichita can draft an ironclad prenuptial agreement, which can specify that your business and all of its assets are not to be considered shared marital property. In the event that you’re already married and you did not consult a family lawyer to draft a prenuptial agreement, you do still have options for protecting your business during a divorce. Contact a family law expert with experience drafting postnuptial agreements. These documents are much like prenuptial agreements, except that they are entered into after marriage. The courts do not give postnuptial agreements as much weight as prenups; however, having one can improve your chances of retaining the assets of your business.

-

Take Time To Review Us

We’d love to hear from our clients. If you’ve had a positive experience with our office, take a few minutes to post a review us on our Google+ page .

-

The Importance of Finding a Lawyer with Experience in Agribusiness Law

Any lawyer can draw up a contract or advise a client as to applicable state laws and regulations. But only an experienced agribusiness lawyer near Wichita can draw from an in-depth knowledge of the challenges that farmers face on a daily basis. A good agribusiness lawyer doesn’t only ensure that their clients remain in compliance with chemical regulations; he or she also helps agribusinesses flourish in today’s demanding marketplace.

Any lawyer can draw up a contract or advise a client as to applicable state laws and regulations. But only an experienced agribusiness lawyer near Wichita can draw from an in-depth knowledge of the challenges that farmers face on a daily basis. A good agribusiness lawyer doesn’t only ensure that their clients remain in compliance with chemical regulations; he or she also helps agribusinesses flourish in today’s demanding marketplace. An agricultural lawyer works closely with livestock, grain, and produce companies to facilitate agribusiness growth across a range of areas. For example, your agricultural lawyer can provide expert advice with regard to farm labor and immigration issues, farm leases, agriculture loans and workouts, and entity formation. Agricultural law also encompasses groundwater and irrigation issues, farm estate planning, business finance, and risk management. With all the expertise that a veteran agricultural lawyer brings to the table, your agribusiness can’t afford not to work with one.

-

How the FTC and Department of Justice Review Mergers

If you’re planning a business merger, it’s essential to work with a business law firm near Wichita. Your business attorney can help you understand the review process conducted by the Federal Trade Commission (FTC) and the Department of Justice (DOJ). Merger reviews are mandated by the Hart-Scott-Rodino Act. They are intended to reduce the risk of allowing an anticompetitive merger to take place. Since the FTC and DOJ share jurisdiction in this area of business law, they are responsible for assigning a particular merger to one agency or the other.

If you’re planning a business merger, it’s essential to work with a business law firm near Wichita. Your business attorney can help you understand the review process conducted by the Federal Trade Commission (FTC) and the Department of Justice (DOJ). Merger reviews are mandated by the Hart-Scott-Rodino Act. They are intended to reduce the risk of allowing an anticompetitive merger to take place. Since the FTC and DOJ share jurisdiction in this area of business law, they are responsible for assigning a particular merger to one agency or the other. Preliminary Review

Most proposed business mergers require only one review. After your business lawyer reports the proposed deal to the FTC and DOJ, the involved parties are required to wait 30 days for the review to conclude before completing the deal. In the event that the deal involves a bankruptcy transaction or cash tender, the parties must only wait 15 days. During that time, the agency will review the proposed deal to determine if it might violate antitrust laws. The reviewing agency may take one of several actions. It may simply let the waiting period expire, in which case you will be free to complete the deal. Or, the agency may opt for an early termination of the waiting period, in which case you are allowed to complete the deal before the end of the waiting period. Thirdly, if antitrust issues are involved, the agency may request additional information and take a closer look at the proposal.

Second Review

While most proposed business mergers are allowed to proceed after the preliminary review, a few are affected by a second request, or extended review. The business attorneys for all involved parties will provide the additional information requested by the reviewing agency. Once they have done so, the parties must wait another 30 days for the second review. If the deal appears satisfactory to the agencies, they will close the investigation and allow the proposed deal to go forward. Otherwise, the second review may lead to a settlement with the companies. Or, the agencies may use the federal courts or administrative processes to prevent the deal from moving forward.

-

Employment Law Issues Businesses Face

Businesses must comply with an array of various regulatory requirements that concern employees, from the safety of the workplace to the proper firing of employees. Since employment law is highly complex and multifaceted, it’s in a business owner’s best interests to work with a business lawyer in Wichita. A business attorney can review the company’s policies and procedures to ensure they are fully compliant, and can alert the owner and supervisors as to best practices.

Businesses must comply with an array of various regulatory requirements that concern employees, from the safety of the workplace to the proper firing of employees. Since employment law is highly complex and multifaceted, it’s in a business owner’s best interests to work with a business lawyer in Wichita. A business attorney can review the company’s policies and procedures to ensure they are fully compliant, and can alert the owner and supervisors as to best practices. Hiring and Firing Procedures

Allegedly inappropriate or discriminatory hiring and firing procedures form the basis of thousands of complaints submitted to state agencies and the Equal Employment Opportunity Commission (EEOC). As your business lawyer can inform you, even if your company is scrupulous in adhering to proper hiring and firing procedures, the mere appearance of discriminatory practices can result in a litigation nightmare. Your business attorney can advise you as to proper documentation in all hiring and firing procedures to protect your company from these claims.

Wage and Hour Issues

Another common challenge with regard to business law is wage and hour issues. For example, even if your business rigorously complies with the federal minimum wage, you may fall afoul of the law if your state mandates a higher minimum wage. Your business may also run into legal trouble if your employees are only paid for their scheduled hours, despite regularly starting and ending work outside of those constraints.

Discriminatory Incidents

Employers are subject to both federal and state discrimination and harassment laws. Your business lawyer can review your anti-discrimination policy to ensure it is in full compliance with both state and federal laws. Many discrimination complaints have been filed on the basis of age discrimination, sexual harassment in the workplace, race discrimination, and gender discrimination.

Safety Regulations

All employers are required to follow safety protocols to maintain a safe working environment. Your business lawyer can advise you as to the OSHA requirements for your particular industry, and can help you establish clear guidelines and enforcement procedures for your employees.

-

How to Choose a Business Structure

How to Choose a Business Structure

Before you can start your business, you need to decide which structure it will have. If you’re not quite sure which business structure is right for your needs and preferences, it’s best to consult a business law firm near Wichita . A business lawyer can explain the differences between a limited liability company (LLC) and limited liability partnership (LLP), for example. You can also learn about partnerships and being a sole proprietor. Your corporate attorney can help you consider some important factors before choosing a business structure.

You can hear more about the factors you should consider by watching this video. This expert encourages entrepreneurs to consult a business attorney to discuss preferences for exposure to liability and tax implications.

-

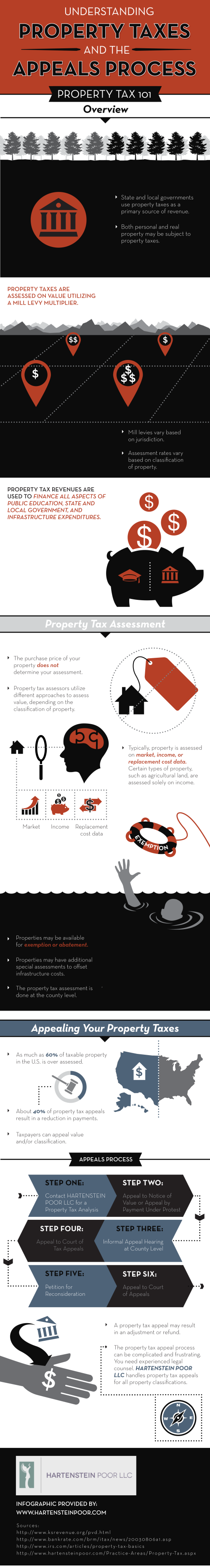

Understanding Property Taxes and the Appeals Process

Property taxes have been around for many years, with evidence showing that even ancient civilizations levied taxes on property owners. While much has changed since ancient times, homeowners are still required to pay property taxes that are dependent on a property’s assessed value. Property taxes can be calculated in a few different ways, but research shows that as much as 60% of taxable property in the country is assessed at more than it is actually worth. If you think your property taxes are unreasonable, trust Hartenstein Poor LLC, property lawyers near Wichita , to help you through the appeals process. Approximately 40% of appeals result in a reduction of fees or a refund, so protesting your taxes could pay off. Take a look at this infographic to understand more about the basics of property taxes and why you should consider appealing. Please share with your friends and neighbors.